Equity

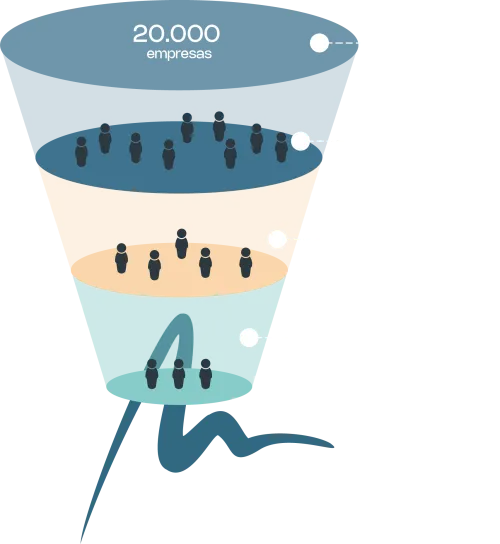

In the first phase, we use an internally developed quantitative model based on technology, artificial intelligence, and algorithmization, which allows us to eliminate more than 90% of the companies in a universe comprising 20,000 assets. In this initial assessment, we evaluate the state of each business by analyzing ratios such as ROCE, margins, growth, indebtedness, and balance sheet situation, reducing the universe to the 1,200 highest quality assets.

In the second phase, a series of qualitative filters are integrated into the analysis, allowing the selection of the 400 highest quality companies organized into ten deciles based on various competitive advantages. This part of the process involves analyzing switching costs, network effects, brand, patents, licenses, processes, location, unique assets, and economies of scale.

In the third phase, the depth of financial analysis is increased for each of the 400 companies, focusing on valuation ratios such as sales estimates, earnings, business lines, and free cash flows, enabling us to determine the appreciation potential for each stock.

In the fourth and final phase, exposure is structured by sector, geography, and name, building a portfolio of the 80 highest quality companies with the greatest potential for appreciation. The portfolio is structured under rigorous risk control, divided into four quartiles where each idea represents a weight of 2% in the first quartile, 1.5% in the second, 1% in the third, and 0.5% in the fourth, resulting in the best quality/return/risk ratio.