Fixed Income

In the first phase, a detailed analysis of global macroeconomic conditions and how they may affect our investment universe is conducted. This includes studying the slopes of interest rate curves, geopolitical events, central bank monetary policies, and key economic indicators.

In the second phase, we thoroughly analyze the opportunities resulting from our initial analysis, determining the optimal weightings by country and sector. At the same time, we decide the average maturity duration of assets, the currencies with the highest weighting, and the participation percentage in major issuers.

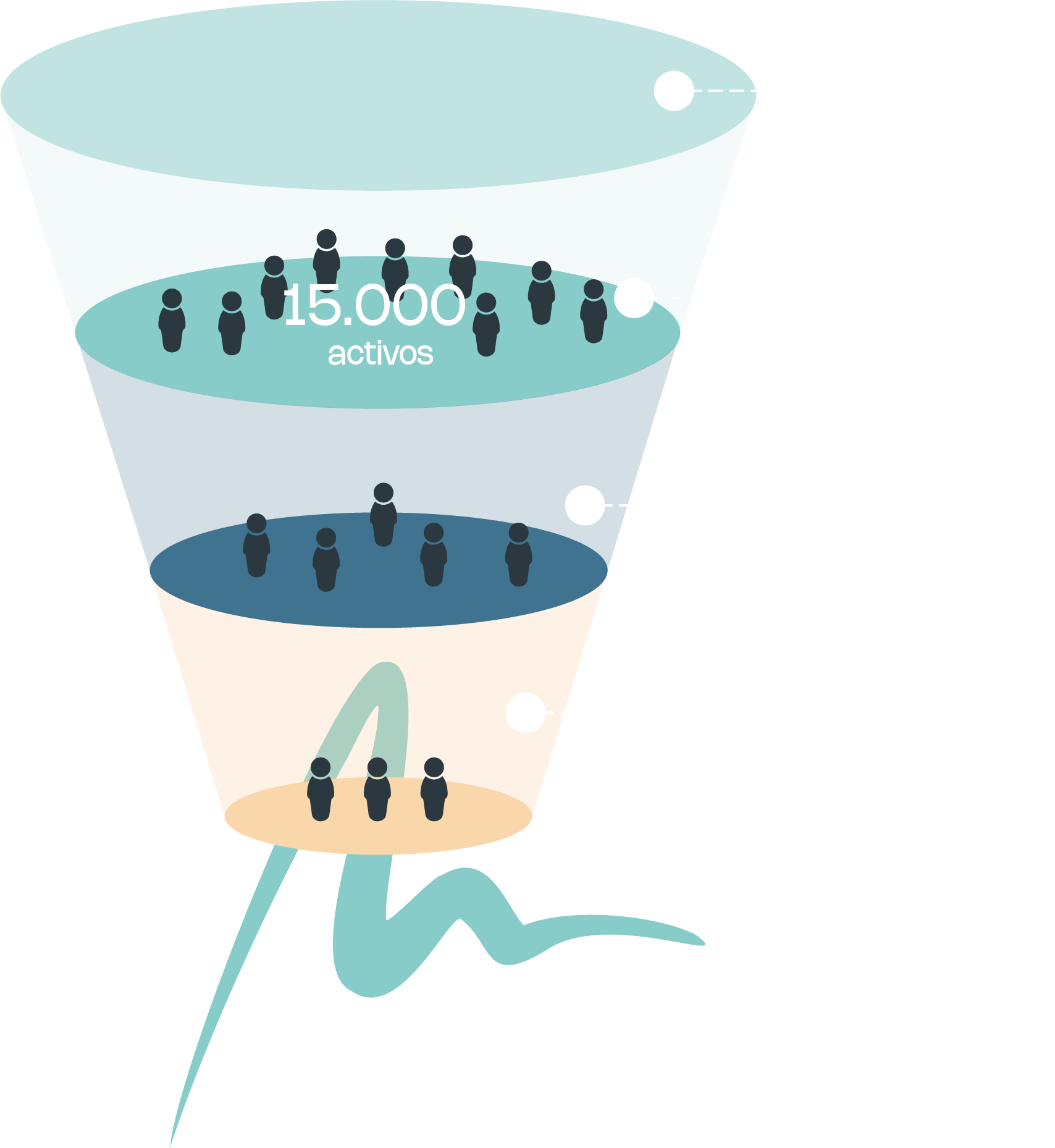

In the third phase, we use an internally developed quantitative model based on technology, artificial intelligence, and algorithmization, allowing us to eliminate more than 90% of companies in a universe comprising over 15,000 assets. In this phase, we analyze company metrics, capital structure, liquidity, seniority, and ESG factors, filtering the universe to the 1,500 highest quality assets.

In the final phase, qualitative analysis is integrated, and relative value techniques, technical analysis, and statistical methods are applied, enabling us to select the best opportunities, building a portfolio of 80 to 120 high-quality assets undervalued by the market.